Our content is funded in part by commercial partnerships, at no extra cost to you and without impact to our editorial impartiality. Click to Learn More

QuickBooks Payroll pricing starts at $45 per month, plus $6 per employee for its Core plan. However, you’ll find the best balance between features and price on the next plan up, Premium, which costs $80 per month, plus $8 per employee.

With inflation rates climbing, finding great value business software solutions has become more important than ever. QuickBooks Payroll offers a high-quality payroll package that’s priced in line with the industry average. Its pricing aligns closely with typical HR software prices, making it a viable option for small to medium-sized businesses. While it may not be the strongest payroll software we’ve tested (that accolade goes to Rippling), it still offers an excellent hand of features and reliable customer support options.

In this guide to QuickBooks’ Payroll pricing, we break down the cost of the provider’s payroll plans and discuss their feature and value offering. Read on to find out whether QuickBooks Payroll is right for you.

| Price | Highlights | Support | 1099 E-file | Time tracking | Dedicated HR advisor | |||

|---|---|---|---|---|---|---|---|---|

| QuickBooks | QuickBooks | QuickBooks | ||||||

| Core | Premium | Elite | ||||||

| $45/month + $8/employee/month | $80/month + $8/employee/month | $125/month + $10/employee/month | ||||||

|

|

| ||||||

|

|

| ||||||

| | | | ||||||

| | | | ||||||

| | | |

QuickBooks Payroll Pricing Plans

QuickBooks offers three Payroll plans, each offering more features than the last. A 30-day free trial is also available, and there’s a money-back guarantee for those who decide they need to cancel.

- Core – $45 per month, plus $6 per employee per month. You’ll get a full-fledged payroll system, including next-day direct deposit and health benefit management.

- Premium – $80 per month, plus $8 per employee per month. This plan adds features for large employee groups, including same-day direct deposit, time tracking, workers’ compensation, and HR resources.

- Elite – $125 per month, plus $10 per employee per month. The enterprise-level plan.

QuickBooks currently has a deal for half off of the first three months across all plans. They call it a “limited time” offer on their site, but it’s been up there a while now, and we’re starting to get suspicious. Regardless, we’ve included the full prices here, as you’ll be paying them after three months anyway.

QuickBooks Core: $45 per month plus $6 per employee

Included on this plan:

- Full-service payroll

- Payroll automation

- Tax automation

- Tax forms

- Health benefits

- 401(k) plans

- 1099 E-File & Pay

- Next-day direct deposit

- Chat support: 24/7

- Phone support: Mon-Fri 6 am to 6 pm, PT. Sat 6 am to 3 pm, PT.

The QuickBooks Core plan costs $45 per month, plus $6 per employee per month. With it, you’ll get everything you need to operate the basics of a payroll service for your employees, with a fully automated process for sending payroll and tracking taxes. In addition, you’ll be able to supply health benefits and 401(k) plans, although the latter is through a third-party service, Guideline, rather than Intuit. Core’s next-day deposit process is reasonably fast: Submit payroll as late as five pm PT on the day before payday, and employees will get paid on time.

QuickBooks Core if you’re looking for a simple, easy, and painless way to pay your employees and file your taxes. QuickBooks remains one of the most popular payroll services, and the Core plan is a great way to get all the essentials. However, the price is higher than some competitors’ starter plans, so you can likely find a better value for a “just the basics” plan from other brands — see our guide to the best payroll software for small businesses.

What’s New: In 2023, Core increased its per-employee fee to $6 per month, up from $4 per month — if you have a lot of employees, this could be a big reduction in value-to-cost ratio.

The worker’s tab within the QuickBooks Payroll software allows managers to see each worker’s payroll information. Image source: QuickBooks

QuickBooks Premium: $80 per month plus $4 per employee

Included on this plan:

- Everything in Core

- Workers’ comp

- HR support center

- Expert review

- Time tracking

- Same-day direct deposit

- Chat support: 24/7

- Phone support: Mon-Fri 6 am to 6 pm, PT. Sat 6 am to 3 pm, PT.

The QuickBooks Premium plan costs $80 per month, plus $8 per employee per month. You’ll get all the features in Core, plus extra functionality geared towards a growing business. You can connect your preexisting worker’s compensation policy, or get a new one through Intuit’s broker, AP Intego. An HR support center is available through another third-party, Mammoth, Inc., to help managers ensure compliance with state and federal law.

In addition, same-day direct deposit is supported, letting you submit payroll as late as 7 am PT on the morning of payday. Time tracking is also available for the first time, ensuring you can stay aware of your employees’ hours logged, even if your teams has grown large enough that employee engagement risks becoming unwieldy.

QuickBooks says that Premium is its most popular plan. It delivers comprehensive payroll, makes it easy to connect or add employee benefits, and adds HR support that can guide a business through the process of helping its employees. Premium is a great fit for a business that has complex payroll needs, offering great features at a fair (if not low) price.

What’s New: In 2023, Premium increased its base fee to $80 per month, up from $75 per month — slightly reducing the value for its cost.

Elite

Included on this plan:

- Everything in Premium

- Expert setup

- Project and labor tracking

- Tax penalty protection

- Personal HR advisor

- Chat support: 24/7

- Phone support: 24/7

The QuickBooks Elite plan costs $125 per month, plus $10 per employee per month. It doesn’t add quite as many additional features as the Premium plan adds to Core, but it does increase the personnel that can be summoned at a moment’s notice. Elite gives its users 24/7 phone support in addition to chat, a QuickBooks payroll expert to onboard and complete your one-time setup, and – via Mammoth, Inc. – the opportunity to schedule one-on-one phone or online consultations with certified HR advisors.

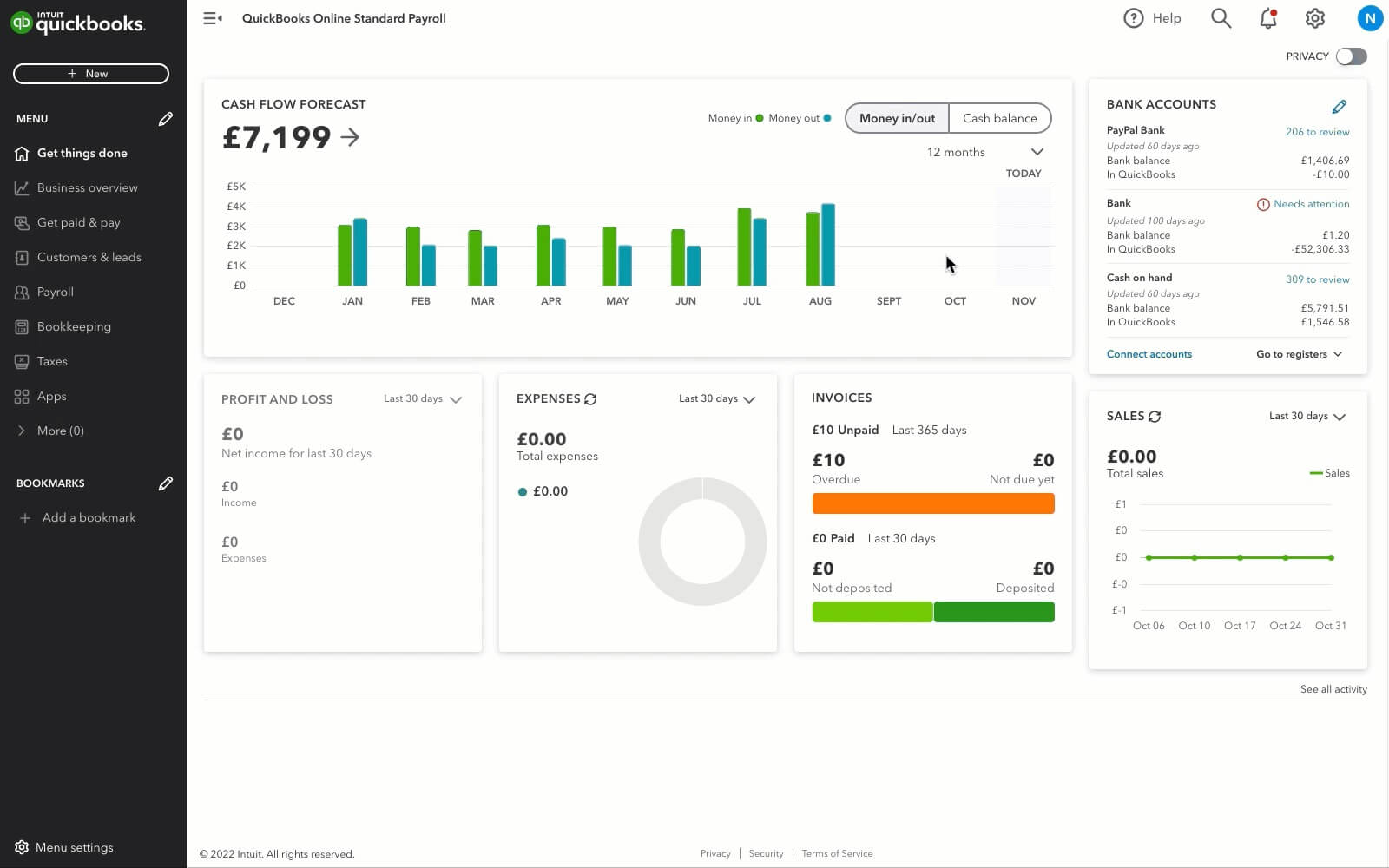

The QuickBooks Payroll dashboard can display key data in real-time. Image source: QuickBooks

New features include an expanded time tracking ability: You’ll be able to track employees by project hours, account for labor expenses, and using a geofencing feature to prompt employees to sign in as they arrive and sign out as they leave. The plan’s tax penalty protection is the final new addition, paying all of your business’s IRS penalty fees and interest on mistakes made through its software for up to $25,000 per year – an enterprise-level feature if we’ve ever heard one.

Elite is best only for truly huge enterprise businesses, and stands out for its granular employee-tracking functionality and impressive 24/7 support options.

Elite provides a good value — but only for businesses so large that they need a high level of support constantly.

Does QuickBooks Payroll Have a Free Plan?

There is no permanent free plan for any payroll services from QuickBooks. However, you can get a free 30-day trial of all three plans — Core, Premium, and Elite. Or, if you skip the free trial, you can instead get your first three months for 50% off, and ultimately save even more money than you would with a free trial.

There are a handful of free payroll providers, although they came with caveats like a cap on the number of employees, or support for contractors but not salaried workers. Read our guide to the best free payroll software for more information.

Quickbooks Payroll Review

If you’re already using QuickBooks accounting service, QuickBooks payroll can be used as a useful way to manage your business’s payroll. It’s also available as a stand-alone product, but it didn’t make it into the list of our top eight providers in our last round of testing because its value offering isn’t as strong as lots of its competitors. This being said, there are still a lot of reasons why we think QuickBooks is a great payroll software.

Taxes and paychecks can be automated through QuickBooks, meaning that the core benefits of the software will run by themselves every time payday rolls around. Next- or same-day direct deposits are supported, depending on the plan, but either one helps make payroll simple. The service’s time tracking tools give managers greater visibility as well, while payroll reports make it easy to gain insight on categories including wages, taxes, employees, benefits and perks, and time activities.

A large list of more than 650 integrations will help users address other business needs, including accounting and invoicing. And, thanks to QuickBooks’ plan structure, perks most useful to larger companies are available on higher priced plans – like tax penalty protection and expanded 24/7 support options.

How Does QuickBooks Compare Against Other Payroll Software?

| Starting price | Rating | Key Features | |||

|---|---|---|---|---|---|

| SPONSORED | TOP RATED | ||||

| $8/month/employee (custom prices) | $49/month + $6/employee | $49/month + $6/employee | $8 per month, per employee (currently discounted to $6.40) | ||

| 4.3 | 4.6 | 3.4 | 4.5 | 4.3 | 3.8 |

|

|

|

|

|

|

While QuickBooks offers decent value and seamless integrations with other QuickBooks services, it didn’t perform as strongly as its competitors in the last round of our research.

Rippling was our highest-rated payroll solution. The provider boasts flawless data compliance, its own custom app for employees, and lower entry prices than QuickBooks – making it the favorable option for businesses with tighter budgets. However, Rippling only makes its per-user pricing public ($8 per employee per month), while keeping its base monthly price available upon request, making the service tough to directly compare against QuickBooks Payroll’s starting cost of $45 per month, plus $6 per employee.

Read our full Rippling review.

Alternatively, PayChex is our top pick for businesses after full control over their payroll processes, because it offers instant payment features and a range of granular reporting options. Paychex starts at just $39 per month, plus $4 per employee per month, making it less expensive than QuickBooks’s lowest plan.

ADP Run, on the other hand, is more adept than QuickBooks at scaling alongside growing businesses. Due to its seamless HR add-ons, open API, and multitude of integration partners, APD was the only provider in our testing to receive a perfect score of 5/5 for scalability. And at a time when 30% of finance HR leaders doubt whether their payroll system can support their plans for expansion, the need for a scalable solution like ADP isn’t going away anytime soon. ADP doesn’t have public pricing, but it starts at $79 per month, plus $4 per employee, making it a little less pricy than QuickBooks Payroll Premium, though more expensive than QuickBooks Payroll Core.

How Did We Research QuickBooks Payroll?

We take our impartial research and analysis seriously, so you can have complete confidence that we're giving you the clearest, most useful product recommendations.

After conducting an initial exploration to identify the most relevant, popular, and established tools in the market, we put them through their paces to see their real strengths and weaknesses. In this case, we put eight payroll software platforms to the test across 56 areas of investigation.

Based on years of market and user needs research, we've established a payroll software research methodology that scores each product in five main categories of investigation and ten subcategories; this covers everything from levels of data security and user control, to the customer support each provider offers and much more.

Our main research categories for payroll software are:

- Control: the level of customization and flexibility provided by the payroll software in managing and processing payroll. It includes features such as the ability to define pay periods, customize earnings and deductions, set up tax withholding rules, and manage employee data.

- Data Security: the measures and protocols implemented by the payroll software to ensure the confidentiality, integrity, and availability of sensitive payroll information. This includes encryption of data, secure data storage, access controls, backup and disaster recovery procedures, and compliance with data protection regulations.

- Expertise: the level of knowledge and guidance provided by the payroll software vendor or support team. This can include resources such as documentation, tutorials, training materials, and access to payroll experts who can assist users with payroll-related questions.

- Scalability: the ability of the payroll software to accommodate the growth and changing needs of a business. It includes factors such as the capacity to handle an increasing number of employees, support multiple locations or entities, and adapt to evolving payroll requirements include HR related functionality and employee benefits.

- Customer Support: the various channels and methods available for users to seek assistance and support from the payroll software vendor. This can include email or ticket-based support, phone support, live chat, community forums, and self-help resources

When it comes to calculating a provider's final score, not all research areas are weighted evenly, as we know some aspects matter more to our readers than others. After hundreds of hours, our process is complete, and the results should ensure you can find the best solution for your needs.

At Tech.co, we have a number of full-time in-house researchers, who re-run this research process regularly, to ensure our results remain reflective of the present day.

Verdict: Is QuickBooks Payroll Worth Its Price?

Yes, our research found QuickBooks Payroll is definitely worth its price. Its features and support options are particularly stellar across all plans, and it has more than satisfactory analytics as well. Pricing is fair, and it’s easy to understand as well: The more users pay, the more access to features and support options they’ll get in return.

That said, plenty of payroll software is worthy in its own right, and might be preferable for certain companies – ADP RUN offers more customizable reports, while Paychex offers much more impressive staff payment features. Check out your options to find which one is right for you.

That said, the service with the most flexible pricing plan is Square Payroll, which starts at just a $29 monthly fee, plus $5 per employee per month.

If you click on, sign up to a service through, or make a purchase through the links on our site, or use our quotes tool to receive custom pricing for your business needs, we may earn a referral fee from the supplier(s) of the technology you’re interested in. This helps Tech.co to provide free information and reviews, and carries no additional cost to you. Most importantly, it doesn’t affect our editorial impartiality. Ratings and rankings on Tech.co cannot be bought. Our reviews are based on objective research analysis. Rare exceptions to this will be marked clearly as a ‘sponsored’ table column, or explained by a full advertising disclosure on the page, in place of this one. Click to return to top of page